In our constantly evolving economy, where the rise of living costs shows no sign of slowing, many of us confront a stark and pressing reality: access to dental care—an integral component of our health—is becoming increasingly elusive. If you wonder, “How can I pay for dental work with no money,” know this: while you can’t afford dental work, you are far from alone. The weight of financial strain and dental pain can often seem like a mountain too steep to climb, yet there remains a glimmer of hope.

Despite the squeeze of economic pressures, there are still innovative and feasible ways to ensure that your dental health, those pearly whites, receive the attention they urgently need when you can’t afford dental work. What follows are seven actionable strategies to navigate the financial hurdles of dental care, ensuring that your smile is preserved even when finances are tight.

1. Use a Credit Card

Picture this: can’t afford dental work, and you’re suddenly faced with a dental emergency—a necessary root canal or crown that demands immediate attention. Conventional wisdom cautions against the pitfalls of credit card debt, painting it as a financial trap. But what if, in certain circumstances, this feared tool could morph from a burden into a lifesaver?

Here’s an intriguing angle: opting for a new credit card offering a 0% introductory APR isn’t merely about postponing payment. It’s about strategically leveraging a financial instrument to your advantage when you can’t afford dental work. This approach isn’t just delaying the inevitable—it’s about smartly navigating a temporary setback, giving you the breathing room to manage your finances without the immediate sting of interest, and transforming what is often seen as a last resort into a thoughtful stopgap measure.

It’s a calculated strategy, offering a grace period where significant dental costs can be managed without the immediate onset of interest. Whether it lasts six months or a year, this window allows strategic financial breathing room. You’re not just putting off inevitable payments; you’re planning your financial recovery with precision.

When selecting such a credit card, choosing one that aligns more closely with healthcare management is advantageous. Look for cards that offer rewards or cashback on medical expenses. These are not just perks; they are tools that can lessen the financial impact of each dental visit. Moreover, some cards include benefits such as purchase protection or extended warranties—features that, at first glance, seem unrelated to medical care but can significantly enhance your overall financial strategy by safeguarding other aspects of your spending.

The critical element of this strategy, however, is disciplined usage. The effectiveness of this approach hinges entirely on your ability to pay off the balance within the introductory period. When you can’t afford dental work, using a credit card responsibly transforms it from a potential risk to a strategic asset. It becomes a deliberate choice to bridge the gap between emergency and solution, ensuring the immediate treatment of dental issues and the long-term health of your finances.

2. Explore Dental Insurance Options

Sometimes, the solutions we seek are closer than we realize. Consider dental insurance—a potential gem overlooked in the rush of everyday life. Many employers offer dental coverage at group rates that are surprisingly affordable, yet this benefit frequently remains untapped, like a book unread on a shelf.

Take a moment to revisit your employer’s benefits package. Within those pages lies a valuable provision for dental insurance that could significantly offset costs when you can’t afford dental work. When your workplace doesn’t offer dental benefits, it might initially seem like a significant disadvantage. However, this scenario opens the door to an opportunity for deeper exploration and, perhaps, a better understanding of what is truly available to you. Major dental insurance providers like BlueCross Dental and Aetna Dental offer individual plans that warrant a closer look—not just as a fallback option but as a potentially superior choice.

If you’re asking yourself, “How can I pay for dental work with no money,” dive into the specifics of these plans with the curiosity of a detective piecing together clues. This is more than a routine exercise; it’s an exploration that could redefine how you manage your dental health care. Each plan’s details, from what treatments are covered to the out-of-pocket costs, are pieces of a larger puzzle. By assembling these pieces, you can significantly alleviate the financial strain of dental care. It’s not just about finding coverage—it’s about discovering a strategy that aligns perfectly with your needs.

In evaluating these plans, the subtleties matter greatly. Consider the waiting periods, which might delay your immediate use of the services, or the annual maximums, which cap your spending each year. These aren’t just bureaucratic details; they’re critical factors that shape the usefulness and effectiveness of your coverage.

3. Take Advantage of Personal Loans

When you’re stuck wondering, “How can I pay for dental work with no money,” it’s crucial to consider all available financial tools. When considering the steep costs of dental care, it may be prudent first to steer clear of seemingly drastic measures like personal loans or tapping into a 401(k). However, a closer examination reveals a narrative that is less about risk and more about strategy. This perspective shift turns these financial tools into sensible, calculated choices for navigating a common bind.

Personal loans, often approached with trepidation due to the specter of high interest rates and the specter of long-term financial burden, actually present a compelling advantage when compared to alternatives like accruing credit card debt. These loans typically come with lower interest rates and offer longer repayment terms, creating breathing room in monthly budgets that can alleviate immediate financial stress. Engaging in this process—submitting proof of income and undergoing a credit check—isn’t merely a formality. It’s a step towards designing a clear, manageable financial pathway in collaboration with your lender, transforming the journey into a partnership rather than a solo venture.

This transparency ensures that you agree with your eyes wide open and are fully aware of your commitments and capabilities.

Simultaneously, when you can’t afford dental work, reevaluating the role of your 401(k) as a potential source of funds can be illuminating. Contrary to traditional advice that views these funds as sacrosanct until retirement, there are circumstances where tapping into them makes practical sense. Borrowing from your 401(k) when you can’t afford dental work means borrowing from your future self. The interest paid back into the account turns a potential financial liability into a self-benefitting loop. This elegant solution maintains the integrity of your retirement savings while providing the necessary liquidity for immediate needs.

4. Save Money for Lower-Cost Treatments

“How can I pay for dental work with no money?” is a scenario many face with dread as they confront the high costs of care. The conventional wisdom suggests that such expenses necessitate immediate payment or deferred treatment, yet a third way involves rethinking our approach to saving itself.

Let’s dissect this alternative path: Imagine your dentist advises you that a costly dental procedure is inevitable. Instead of accepting this considerable expense as an immediate burden when you can’t afford dental work, you negotiate for an interim solution—a filling, perhaps, which is significantly cheaper than a crown. This stopgap allows you time to prepare physically and financially, turning what could be a financial shock into a manageable challenge.

Now, set a practical savings goal. Even a modest sum like $10 each week can snowball into a significant reserve over months. This gradual accumulation is less about the mechanics of saving and more about the psychology of it. Each dollar saved is a small victory, a step towards a larger, more daunting financial goal, making the process psychologically rewarding and practically achievable.

Moreover, when you can’t afford dental work, consider harnessing the collective support of your community through crowdfunding. Platforms like GoFundMe tap into the power of communal aid, transforming individual challenges into shared endeavors. This approach not only eases your financial burden but also strengthens communal bonds, providing emotional and financial support.

Furthermore, automatic transfers to a dedicated savings account can instill a discipline that turns sporadic savings into a consistent habit. This method ensures that saving becomes as routine as paying a monthly bill, embedding financial prudence into your daily life.

By making saving a deliberate, thoughtful priority when you can’t afford dental work, you not only build a financial cushion to cover unexpected dental expenses but also foster a sense of control and empowerment. It’s about transforming saving from a mundane financial tactic into a profound, proactive strategy for life’s uncertainties.

5. Take Advantage of CareCredit

CareCredit is not just a financial tool but a pivotal element in the broader story of healthcare accessibility when you can’t afford dental work. This specialized medical credit card, designed specifically for managing hefty dental bills, emerges as a protagonist in the drama of everyday health management. The application process for CareCredit is notably straightforward, a clear departure from the often convoluted procedures associated with traditional credit options. More interesting, however, is the favorable comparison of its interest rates to those of standard credit cards. This detail might easily be overlooked, but is crucial in the economics of healthcare.

CareCredit transcends its role as a mere credit line. It acts as a bridge over the troubled waters of healthcare financing. Whether addressing the urgent needs of therapeutic procedures or the preventative measures that forestall more significant health issues, CareCredit ensures that financial limitations do not delay necessary medical attention. When you can’t afford dental work, this is where CareCredit’s offering gets better: it offers promotional financing options such as deferred interest or low-interest plans, which are not just amenities but lifelines that allow patients to manage their dental expenses over time without the specter of crippling debt.

These financing plans, typically ranging from six to 24 months, depending on the provider and the cost of treatment, are not merely about deferring payments—they are strategic tools that redistribute the financial burden of healthcare. Utilizing these plans when you can’t afford dental work can spread out the cost of expensive treatments, making large bills digestible and less intimidating.

6. Capitalize on Health Savings Accounts (HSAs)

The Health Savings Account (HSA) is not just a financial instrument for managing healthcare expenses, including dental care, but also a manifestation of profound financial foresight. On the surface, HSAs seem straightforward: they allow you to set aside pre-tax dollars, thus reducing your taxable income. This is an immediate, apparent benefit. But the absolute brilliance of the HSA is hidden beneath this surface simplicity in its triple-layered tax advantage: contributions are tax-deductible, the savings grow tax-free, and withdrawals for qualified medical expenses, like dental treatments, don’t touch the taxman either.

This isn’t merely a savings account; it’s a sophisticated financial shelter crafted to protect your money from taxes at every conceivable point, optimizing how you engage with your financial health. When you can’t afford dental work, the HSA essentially turns saving into strategic financial defense, shielding every dollar from the erosive effects of taxes.

Yet, passive participation won’t cut it to tap into the potential of HSAs. This requires a more engaged, strategic approach. Consider this: in 2024, you can contribute up to $3,650 as an individual or $7,300 for a family, with an additional boost of $1,000 available for those 55 and older. To just contribute is one thing; to maximize these contributions is another. By pushing these limits, you’re not merely stashing away money; you’re fortifying a financial stronghold, priming yourself to handle whatever health-related uncertainties might come your way.

7. Use a Dental Office Membership Plan

In the complex tapestry of healthcare economics, the emergence of dental office membership plans is a compelling deviation from the norm. These models are designed for those outside the traditional insurance framework, offering a more direct, economical path to dental wellness. At Definitive Dental, to assist those asking themselves, “How can I pay for dental work with no money?” we have championed a bespoke service plan tailored to our patients’ unique dental needs.

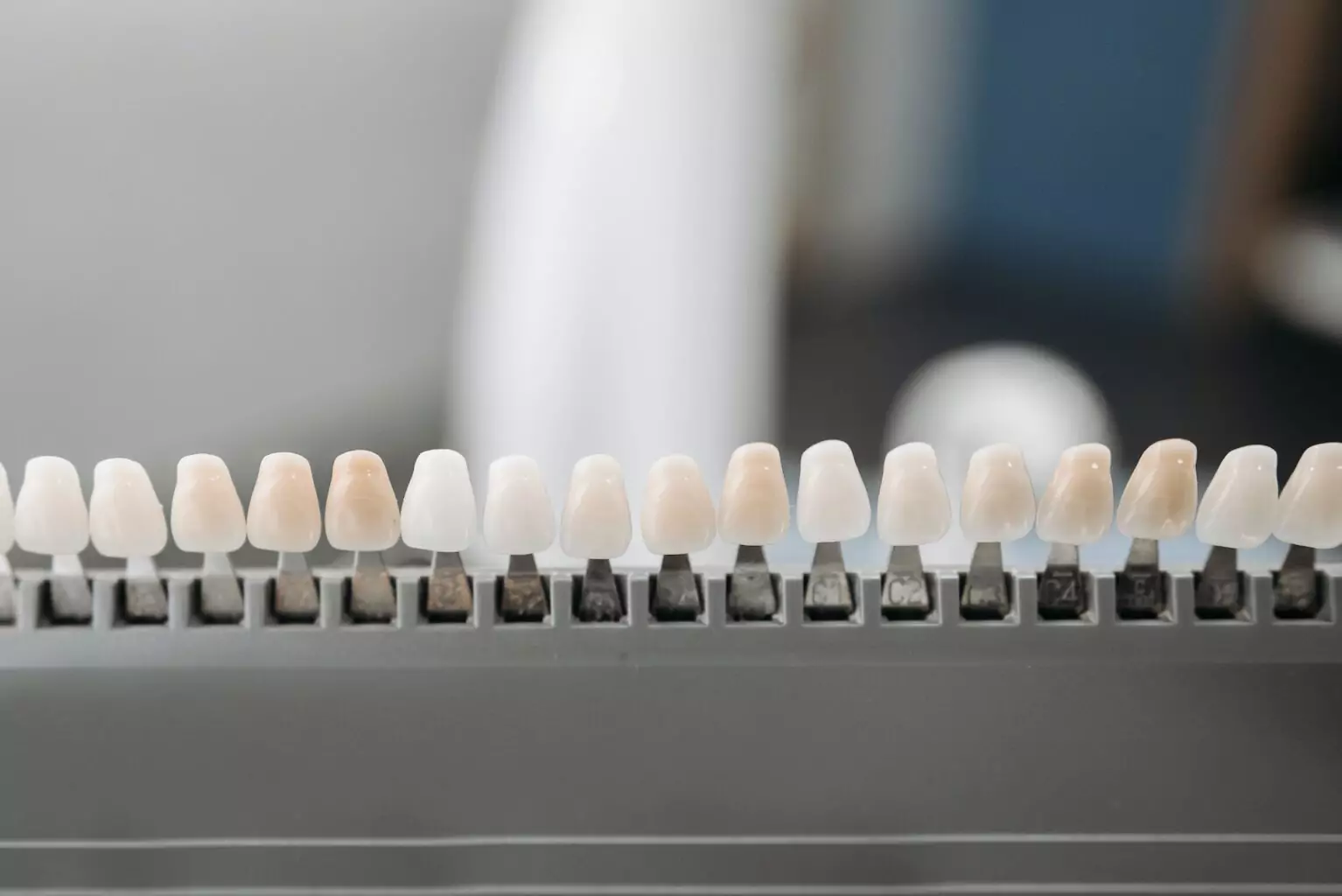

Here’s the ingenious part: for a fixed, modest monthly fee, our members unlock a suite of preventive care—cleanings, exams, X-rays—and discounts on additional services, from routine fillings to elaborate crowns and even aesthetic enhancements. This system isn’t just about mitigating costs—it’s about reimagining the future of dental care as something wholly manageable and predictably budgeted.

Explore Quality Dental Care at Definitive Dental

For those wondering, “How can I pay for dental work with no money?” Definitive Dental stands at the forefront of transforming dental care accessibility. Our strategy? A low-cost dental service plan, a beacon for those deterred by the traditional, often prohibitive cost of dental work.

Consider our membership model: for merely $33 a month or $396 a year, members receive an impressive array of benefits—two regular cleanings, two comprehensive exams including X-rays, and an emergency examination annually. The plan includes two fluoride treatments and a generous 15% discount on all additional services. Remarkably, this comes with the absence of deductibles, maximums, pre-approvals, or waiting periods. The benefits are instant, commencing when you enroll, making it easier to afford dental work.

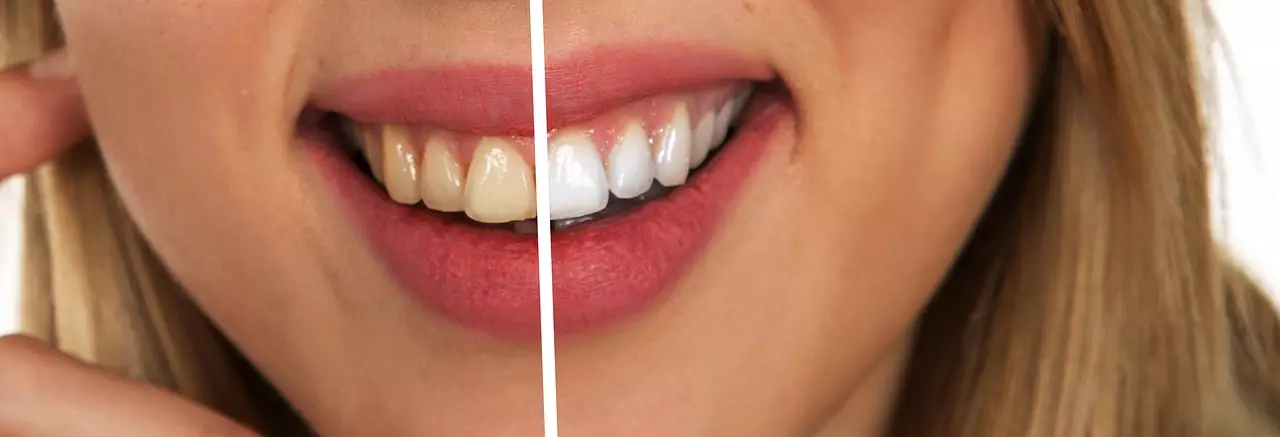

Moreover, we enhance our offering with regular cost-saving specials. New and existing patients can avail themselves of substantial savings, like $1,000 off SureSmile clear aligners or dental implants. For new patients, we offer complimentary Zoom! Teeth whitening and a reduced rate of emergency exams.

Reach out today to learn more and schedule your visit.